The housing market is always evolving, but some shifts are more than just temporary cycles—they represent long-term structural changes that will shape homeownership, affordability, and investment opportunities for decades.

According to a ResiClub report, nine major housing trends are reshaping real estate across the country. From shrinking household sizes to the rise of build-to-rent communities, these shifts will have major implications for buyers, sellers, and investors in Rhode Island.

Let’s dive into these trends and explore how they’re impacting the local housing market in Warwick, Providence, Cranston, and beyond.

1. Household Sizes Are Shrinking

One of the biggest demographic shifts happening right now is that American households are getting smaller. In Rhode Island, this trend is particularly relevant due to:

✅ Delayed life events – Younger generations are postponing marriage and parenthood, meaning more one- and two-person households.

✅ Falling birth rates – Fewer children per household means less demand for larger homes.

✅ Aging population – As Rhode Island’s baby boomer generation ages, more older adults are living alone.

What This Means for Rhode Island:

Increased demand for condos, townhouses, and smaller homes.

More downsizing as older homeowners move out of large single-family homes.

Rising demand for multi-generational housing options.

2. Slower U.S. Population Growth = Less Housing Demand

Over the past 15 years, the U.S. Census Bureau has repeatedly lowered its population projections. The latest forecast predicts 361 million Americans in 2050, which is 80 million fewer people than originally projected.

This slower population growth could reduce overall housing demand in the long term. However, in Rhode Island, the situation is different.

Why Rhode Island is Bucking the Trend:

Boston spillover: Many people looking for more affordable housing outside Boston are moving to Providence, Warwick, and Cranston.

College-driven housing market: With Brown University, RISD, and other institutions, Rhode Island continues to attract out-of-state renters and buyers.

Limited land for new construction: Unlike some Sun Belt states, Rhode Island’s limited land supply keeps home values strong.

Bottom line: Even as national housing demand slows, Rhode Island will remain competitive due to regional migration trends.

3. Declining Fertility Rates Mean Fewer Future Buyers

Birth rates are declining not just in the U.S., but globally. This means that, in the long term, fewer people will enter the housing market as first-time buyers.

What This Means for Rhode Island Real Estate:

More demand for smaller, low-maintenance homes as fewer large families enter the market.

Sellers will need to appeal to different demographics, including young professionals and retirees.

Long-term investment strategies should consider shifting buyer preferences toward multi-functional homes and rental properties.

4. New Homes Are Getting Smaller

For decades, the size of newly built homes in the U.S. kept growing. But since 2014, homebuilders have started to shrink home sizes in response to changing buyer demand and affordability challenges.

Why This Trend Is Happening:

✅ Rising construction costs are forcing builders to design smaller homes to keep prices lower.

✅ Builders are reintroducing more entry-level homes after years of focusing on luxury developments.

✅ First-time buyers are prioritizing affordability over size.

Rhode Island Impact:

Expect to see more compact townhouses, multi-family units, and energy-efficient small homes entering the market as builders adjust to new demand patterns.

5. Remodeling Is Becoming a Bigger Focus

Instead of buying new homes, many Rhode Islanders are choosing to renovate. According to ResiClub, the U.S. is entering a renovation and remodeling boom for three key reasons:

Aging homes: Rhode Island’s housing stock is older than the national average, making renovations a necessity.

Homeowners locked into low rates: Many sellers can’t afford to move, so they’re improving what they have instead.

Rising home equity: Rhode Island homeowners have record levels of home equity, making it easier to fund renovations.

What This Means for Buyers:

Move-in-ready homes are in high demand since fewer people want to take on large renovation projects.

Multi-family properties with separate rental units are becoming more attractive as homeowners look to generate income.

6. The Baby Boomer Sell-Off Will Accelerate

By 2035, there will be 9.2 million fewer baby boomer homeowners, according to Freddie Mac. As boomers age and move out of their homes, this will create new inventory—but it won’t happen all at once.

Freddie Mac calls this shift the ‘silver tsunami,’ but notes that it will happen gradually.

How This Will Play Out in Rhode Island:

Expect more estate sales and inherited properties hitting the market.

Larger homes may take longer to sell, as demand shifts toward smaller properties.

Investors may find opportunities in aging properties that need renovation.

7. Rising Home Insurance Costs Are a Growing Problem

The median annual U.S. home insurance premium rose 33% between 2020 and 2023, and Rhode Island is feeling the impact.

Key Factors Driving Insurance Rate Increases:

✅ More frequent storms and flood risks in coastal areas like Oakland Beach and Misquamicut.

✅ Rising home values and construction costs make claims more expensive.

✅ Insurance companies pulling back from high-risk markets, limiting policy options.

If you’re a homebuyer in Rhode Island, factor in insurance costs when budgeting, especially for coastal properties. If you already own, now’s a great time to review your coverage with The Slocum Agency to ensure you’re not overpaying.

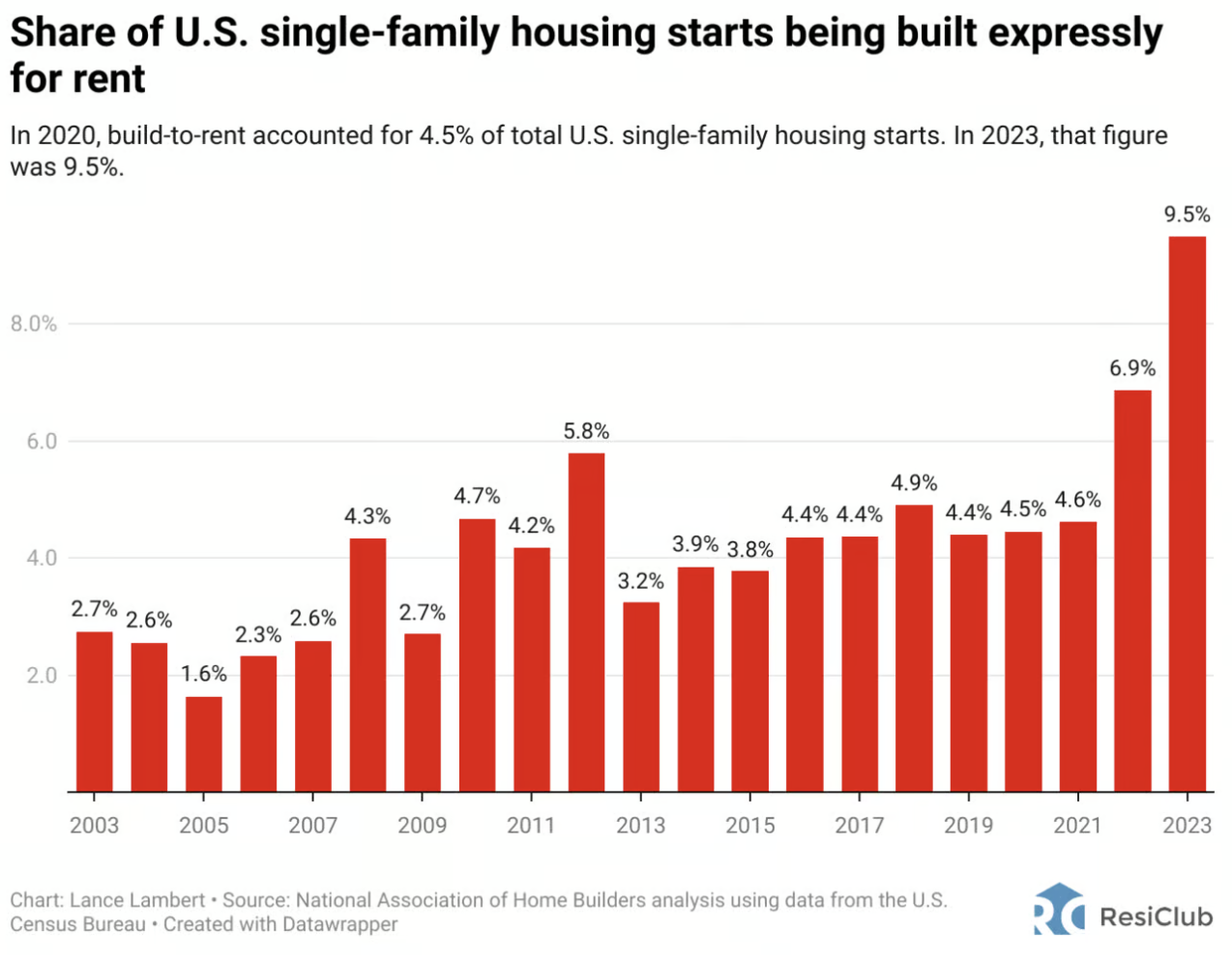

8. Build-to-Rent Communities Are Growing

Large investors are increasingly developing single-family rental communities, especially in fast-growing metro areas.

What This Means for Rhode Island:

Investors may start targeting suburban areas like Rhode Island in the future for build-to-rent projects.

Long-term renters could have more options as developers shift focus.

First-time buyers may face competition from institutional investors in desirable markets.

9. Large Homebuilders Keep Expanding Market Share

Publicly traded homebuilders are taking over a larger share of new home construction, making it harder for small, independent builders to compete.

Why This Matters:

✅ Big builders have more access to financing, allowing them to dominate new construction.

✅ Smaller builders may struggle to get projects off the ground, limiting inventory growth.

✅ Buyers could see more uniform, cookie-cutter developments instead of diverse, custom-built homes.

For Rhode Island, this doesn’t seem to be as big of an issue yet but if that changes, it means that local builders will need to adapt, and buyers may see fewer truly unique new homes on the market.

Final Thoughts: What Should Rhode Islanders Do Now?

These nine long-term housing trends will shape the real estate market for years to come. Whether you’re a homebuyer, seller, or investor, understanding these shifts can help you make smarter real estate decisions.

At The Slocum Home Team, we stay ahead of the market to help Rhode Island buyers and sellers navigate these changes with confidence.

📞 Call Nick Slocum or one of The Slocum Home Team’s top agents today.