How To Win a Bidding War

Tired of losing out on your dream home?

Have you found yourself on the losing end of bidding wars time and time again?

You're not alone.

This market continues to see intense buyer demand and limited housing inventory. We certainly look forward to the days of a more balanced market but it could be quite some time until that's here again. Zillow recently indicated that housing inventory won't return to pre-pandemic levels until the end of 2024.

We've compiled 12 proven strategies that can help your offer rise to the top and secure your dream home. We're here to help you make the winning offer and achieve your homeownership goals.

1. START WITH CURIOSITY

When working with a buyer's agent, they should be your advocate throughout the process. They also act as a buffer between you and the seller during negotiations. At the offer stage, they should be starting by reaching out to the seller's agent and asking questions such as:

What is the most important thing to the seller besides the price?

What is the seller's ideal timing?

What are the seller's biggest concerns about a sale?

How many showings do you have scheduled?

Do you have any offers in hand and if so, how many?

Is there an offer deadline?

This should prepare you to match your offer terms to their wants and desires the best you can.

From there, there are some further steps that you can take to try to gain a competitive edge. Google the seller(s). Look them up on Facebook, Instagram, and LinkedIn. What do you have in common? What mutual friends do you have? If you have mutual friends in common, ask them to reach out on your behalf and put in a good word for you with the seller.

2. ESCALATION CLAUSES

When it comes time to determine what you want to offer, start by ignoring the list price. Some agents intentionally or unintentionally underprice which will drive activity even higher. It's common for homes to sell over the asking price. Start by asking your agent their opinion of value and what the neighborhood supports for a potential market value.

In 2022, Rhode Island saw the median sales price increase by approximately 10%. Based on that, homes appreciated by about $3,077 per month.

Regarding an offer price, while you might need to go a bit higher on price than you'd like to right now, if you miss out on your current offer and don't find another home for a few months, the prices could just continue to go up at that pace!

One strategy many buyers have had success with is using an escalation clause. This is a way for buyers to try to not spend more than they have to but not leave anything on the table either. The way this works (in Rhode Island) is that a buyer would make a base offer but include a clause that says they'll pay a certain dollar value more than any other offer up to a cap.

For example, your offer may be at a base level of $500,000 but you'd indicate you'd be willing to pay $5,000 more than any other offer up to $555,000.

How do you set your cap? We suggest using the "ladder approach". Ask yourself, "Am I willing to lose this home at X dollars?". If not, increase your cap to a higher level. Keep increasing your cap until you're at the line in the sand where if it sells for a dollar more, you can rest easy knowing you gave it your best shot.

We see escalation clauses quite often but they may not help as much as you think, especially if your offer contains other contingencies such as low down-payment financing, full inspections, etc.

I've often seen offers submitted saying they'll pay $1,000 more than any other offer but with their other contingencies, most sellers aren't willing to roll the dice and take on that risk for just $1,000.

If you’re going to use them, make sure to have the escalation amount be substantial. $1,000, $2,500, etc. isn’t cutting it anymore if another buyer has more favorable terms. Consider, $5,000 more, $10,000 more, or if you want to be as aggressive as possible... go right in with your max offer amount and ignore the escalation clause altogether.

3. REVERSE-OFFER DEADLINES

It wasn't all that long ago when we were in a buyer's market where the inventory of homes available for sale far outnumbered the number of buyers in the market. Back then, we'd often see offer deadlines where buyers put an expiration date and time on their offer. But today, we're in the exact opposite market conditions where sellers have all of the leverage and dictate the terms. As a result, we've had to get creative to help our buyers stand out in the crowd.

One tactic that we've had success with in some circumstances is a reverse-offer deadline. Instead of an offer expiration, include a clause such as, “Buyer to increase the offer amount $10,000 if accepted prior to 5 PM today”. This can help incentivize the seller to act quickly and potentially secure a higher price for the property.

To further increase the chances of success, you could offer your maximum amount right away if accepted prior to the weekend's showings or indicate you'll use an escalation clause if not. In that scenario, they'd have to provide evidence they had another offer on the table that triggered your escalation clause. By doing this, you're demonstrating that you're serious and committed to the property, which could increase your chances of being selected.

Of course, some sellers may not want to take the risk and accept your offer right away. Others may still decide to move forward with their planned showings. But by using a reverse-offer deadline, you're giving yourself the best chance of success in a highly competitive market.

4. EARNEST MONEY DEPOSITS

Earnest Money Deposits are the amount you give upfront with a purchase and sales agreement as a sign of good faith. It's the amount of money you put down to demonstrate how serious you are about buying the home. In Rhode Island, that amount is protected by home inspection and mortgage contingencies, unless otherwise waived or altered. At the closing, it is applied toward your down payment.

While risky, you could make your deposit the same amount as your entire down payment or make a portion of your deposit fully non-refundable if you don't close on the home.

Even if you don't decide to go down that route, we recommend making them as large as possible to show the sellers that you're serious and have skin in the game.

5. INSPECTIONS

In Rhode Island, you have 10 business days to do inspections once a purchase and sales agreement is signed. This is your inspection contingency and based on the standard language in the sales agreement, you can terminate the agreement during those 10 days if you're not satisfied with the results of the home inspection or with the seller's response to any of your inspection repair requests. The standard language is VERY buyer friendly.

In what's likely the most common way to try to make your offer a winning offer, many buyers are amending this language to make it more seller-friendly. While they have varying degrees of risk, here are 3 ways to amend the inspection language.

WAIVE THEM OUTRIGHT

This comes with the most risk and is NEVER advised. While we're seeing it more and more, if you're not a general contractor with a high-risk tolerance, this could cause nightmares down the road. In good conscience, we can never recommend this... even in today's market. Some buyers still may choose to do so and we'll have a deeper conversation with you about the potential pitfalls of hidden issues such as structural concerns, mold, termites, etc.

INFORMATIONAL PURPOSES ONLY

While we've been told this doesn't have a lot of substance legally, it's basically a pledge to the sellers that you're going to do inspections but will not make any repair requests after the home inspection. With that being said, you do retain the right to terminate the agreement and protect your earnest money deposit if you're not satisfied with the results.

Home inspections in Rhode Island are not Pass/Fail but this is basically saying you'll move forward on an “As-Is” or you'll terminate the agreement.

SETTING A MINIMUM DOLLAR VALUE FOR ANY REPAIR REQUESTS

This is a way to say to the seller that you're not looking to nickel and dime them and won't be making any requests for repairs that you could likely accomplish with a quick trip to Home Depot on a Saturday morning. You're concerned about big-ticket items and you'll only attempt to renegotiate for anything major.

An example of what this language may look like would be, "Buyer to not make any individual repair requests that would cost less than $XXXX to repair/replace." We often see limits of $1,000, $2,500, $5,000, etc. We suggest making it worthwhile and going to the largest number you feel comfortable with.

6. AMENDING THE INSPECTION CONTINGENCY TIME PERIOD

As we already learned, you have 10 business days to conduct and come to an agreement on any inspection repairs per the standard language in the Rhode Island purchase & sales agreement.

One other way to stand out from the competition is to reduce the time period for the inspection contingency. You could amend the language from 10 to 5 days or whatever you felt comfortable with.

You may also want to try to have an inspector pencil in a time for the inspection when making an offer. This would likely require you or your agent to have a great network of inspectors that they work with as the relationship will be important. Then your buyer's agent can tell the listing agent that you already have an inspection scheduled when presenting an offer. For example, if you're making an offer on a Monday... your agent can tell the seller they have an inspection lined already for Wednesday if your offer is accepted.

This will provide some level of comfort to sellers knowing that if there is an issue, they'll know sooner rather than later.

7. Financing & Appraisals

According to Redfin, you quadruple your chances of getting your offer accepted when making an "all cash" offer, making it the most effective strategy to stand out in a multiple-offer situation.

Unfortunately, not everyone has loads of liquid cash just sitting around allowing them to do this. While it may not be possible for everyone, there are some programs and alternative methods out there to help you make an "all cash" offer.

Some of them are PropTech companies, like Easy Knock, which is a financial product that lets homeowners get cash from their home equity without moving, "rent" back their current home, and purchase a new home without a contingency. There are some lenders out there that will purchase your new home for you without a financing contingency, and let you live in it until your loan is ready to purchase it for them all for a fairly nominal convenience fee. Other more traditional methods to try to become an "all cash" buyer or reduce/amend financing contingencies are bridge financing options, HELOCs, private financing (AKA Hard Money), and self-directed IRAs (please consult with your financial advisor).

AMENDING THE APPRAISAL LANGUAGE WITH AN APPRAISAL GAP

Even though there are numerous programs out there like the ones mentioned above, the vast majority of buyers still need to utilize traditional financing methods. When that's the case, some buyers are trying to make their offers more attractive by indicating that they're willing to cover an "appraisal gap". This means that if the appraisal comes in lower than the purchase price, you'd be willing to pay a certain amount more than the appraised value.

We're seeing many buyers indicate they'd be willing to pay a certain dollar value more than the appraised value in the event it came in under the agreed-upon purchase price. Example language may look like, "Buyer is willing to pay $X more than the appraised value, not to exceed the agreed-upon purchase price, in the event that the appraised value comes in lower than the purchase price." We often see numbers such as $5,000, $10,000, or more. This typically would require more cash out of pocket beyond your down payment. If you're considering this route, please consult with your mortgage lender to see what is possible BEFORE making an offer. Have the conversation upfront.

WAIVING THE APPRAISAL CONTINGENCY

Some buyers choose to not include an appraisal contingency at all if they're comfortable making up the entire difference or if they are financing a very small percentage of the sales price.

If you're not able to cover a difference but don't want to include an appraisal contingency at all in order to help your offer stand out, talk with your lender upfront and pay an additional fee (usually $200-$400) to order a "rush" on the appraisal. This would make sense if you didn't amend the inspection contingency and if the appraisal came in at a level you weren't comfortable with, you'd retain protection during your inspection due diligence period.

Pro-Tip: If you're trying to include language to cover an appraisal gap, minimize your down payment amount to retain the greatest flexibility to have funds available to cover a potential gap.

SHORTENING THE MORTGAGE CONTINGENCY

It's not uncommon in our market to set the mortgage contingency for 21-30 days out and a closing 30-45 days from the point at which your offer is accepted. One way to make your offer more attractive is to shorten the mortgage contingency to 14-20 days. You'll likely need to have a lot of up-front work with your lender done already and order your appraisal right away.

8. MAXIMIZING THE SELLER’S NET PROCEEDS

Smart sellers (or their savvy agents) know it's not necessarily the highest purchase price that always wins but sometimes the offer that will result in the highest net proceeds.

Beyond the purchase price, you could offer to pay for various seller expenses such as:

The commission

A portion of the commission

The seller's tax stamps (transfer taxes)

9. CLOSING DATE

Closing dates, especially if the seller is purchasing another home that coincides with this closing, are critical. If one transaction gets delayed, it often has a domino effect that creates many unhappy parties.

One way to help alleviate this concern is to guarantee an on-time closing. Let the seller know upfront that you're confident in your closing date and are willing to put your money where your mouth is. Consider language such as:

Buyers to pay a $100 per diem fee if the closing is delayed due to the buyer's inability to close on time

Buyers to pay any expenses incurred by the seller for moving and/or storage costs if the closing is delayed due to the buyer's inability to close on time

This strategy would require a rock-solid relationship with your lender and potentially even having your file pre-underwritten. We always recommend working with a local lender who knows our market, the local agents, and can put you in the best position to succeed.

10. RENT-BACKS

There are countless sellers in the marketplace today who would love to sell right now but are worried about where they'll go. It's the #1 concern for the vast majority of anyone considering a sale in today's market. You'll even see many sellers indicate their sale is contingent upon them finding "suitable housing".

One way to help them overcome that fear is to make an offer with a contingency that allows them to "rent back" the home after closing for a certain period of time. The rent could be free (most attractive), at a reduced rate, what they're currently paying for a mortgage payment, what your mortgage payment will be, etc.

Get creative and even if you're not the highest offer, you may skyrocket to the top of the pile with a contingency like this.

11. UNIQUE SELLER BENEFITS

True story, we had a sale in 2021 that had 20 offers on it. When ranking the 20 offers on price alone, we ended up accepting the 8th best offer.

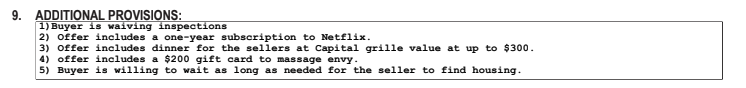

While it wasn't the highest offer, it did include some unique perks that you'll see in the screenshot below.

Was a night out at the Capital Grille or free massage the only reason they accepted the offer?

No.

But it did guarantee that we discussed their offer at length and made it stand out in comparison with 19 other offers that all looked very similar.

In addition to those terms, It was an attractive offer with waived inspections, conventional financing, and large down payment.

Here are some items that you may be able to consider including:

A night out at The Capital Grille.

A year’s subscription to Netflix.

Gift Cards

A Monthly Pizza Night for 1 Year for the seller's family

Pay for the seller's moving expenses

Don't be afraid to think outside the box!

12. PRESENTATION & COMMUNICATION

Presentation matters.

Your agent should be sending your offer with a cover letter summarizing the key points of your offer. Even, better they can include a video and a follow-up phone call introducing themselves, their team, the benefits of working with their team, and the highlights of your offer. Anything they can do to help the other agent feel as though working with your agent will be an enjoyable and smooth experience will help.

You'd be shocked to see how often we get incomplete paperwork with vague terms.

Make it easy for the seller and their agent to accept your offer.

If they're calling for everyone's highest and best offer, put it right onto a purchase and sales agreement so all they have to do is get it signed.

One other thing that helps is to have your lender reach out to the seller's agent to share with them how solid you are as a buyer and how confident they are in getting your loan to the finish line. Every bit helps.

Relationships matter in this business. When an agent on our team is making an offer on behalf of a buyer, we reach out to everyone else on the team to find out if any of our other agents have successfully worked with the listing agent before. If so, we ask that agent to reach out, introduce the other agent, and express how we'll strive to make the entire process from start to finish as easy as possible.

CONCLUSION

It's not easy right now.

There is an art to crafting a winning offer in today's market. Working through the challenges presented by the current market conditions is not for the faint of heart but can be extremely rewarding if you have patience and persistence. Many buyers will opt to wait out the current market conditions but doing so could result in even higher prices and/or higher interest rates. With rents soaring as well, it could make sense even in today's challenging market to do your best to put a team in place to help you secure housing and begin building your own equity.

No matter what happens, we're here when you need us.